Debt-to-Income (DTI) Ratio: The Simple, Friendly Guide For Homebuyers

I’m Brett with Turner Mortgage Team. THANK YOU for being here! Let’s make DTI easy. Because when you understand DTI, you shop smarter, get approved faster, and close on time. GOOD NEWS: you can absolutely master this!

Quick Definition

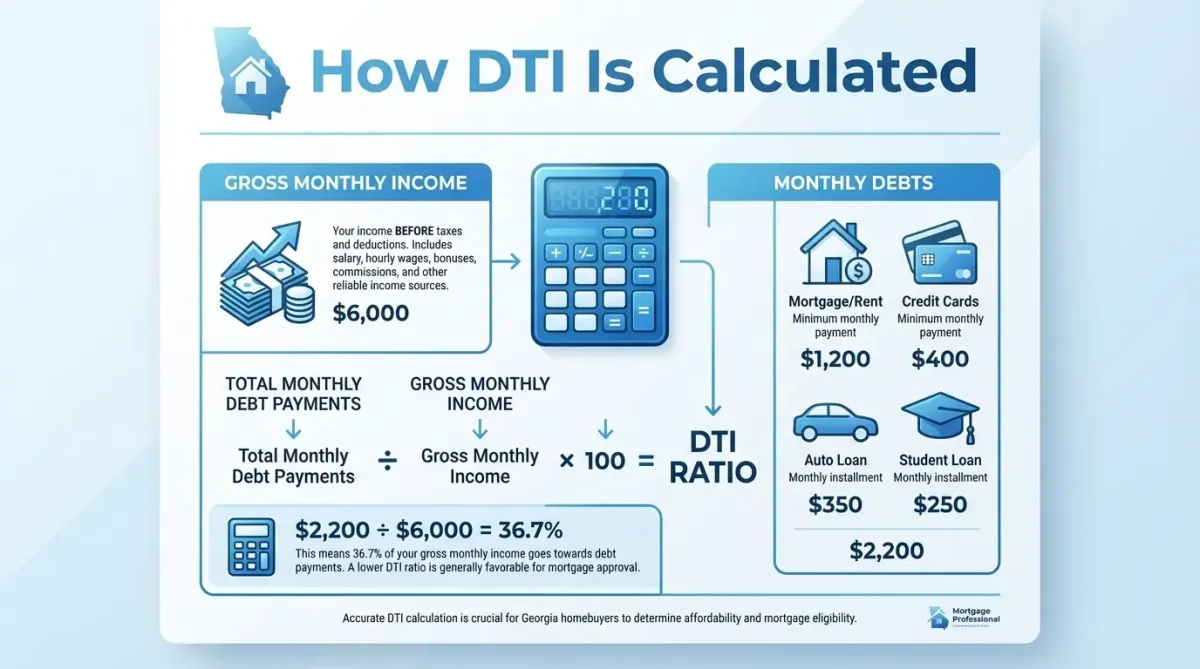

DTI = how much of your gross monthly income goes to monthly debts.

Lenders use it to check if the new mortgage payment fits your budget safely.

The Formula

Total Monthly Debt Payments ÷ Gross Monthly Income × 100 = DTI Ratio

Example: $2,200 in debts ÷ $6,000 income = 0.3667 → 36.7% DTI

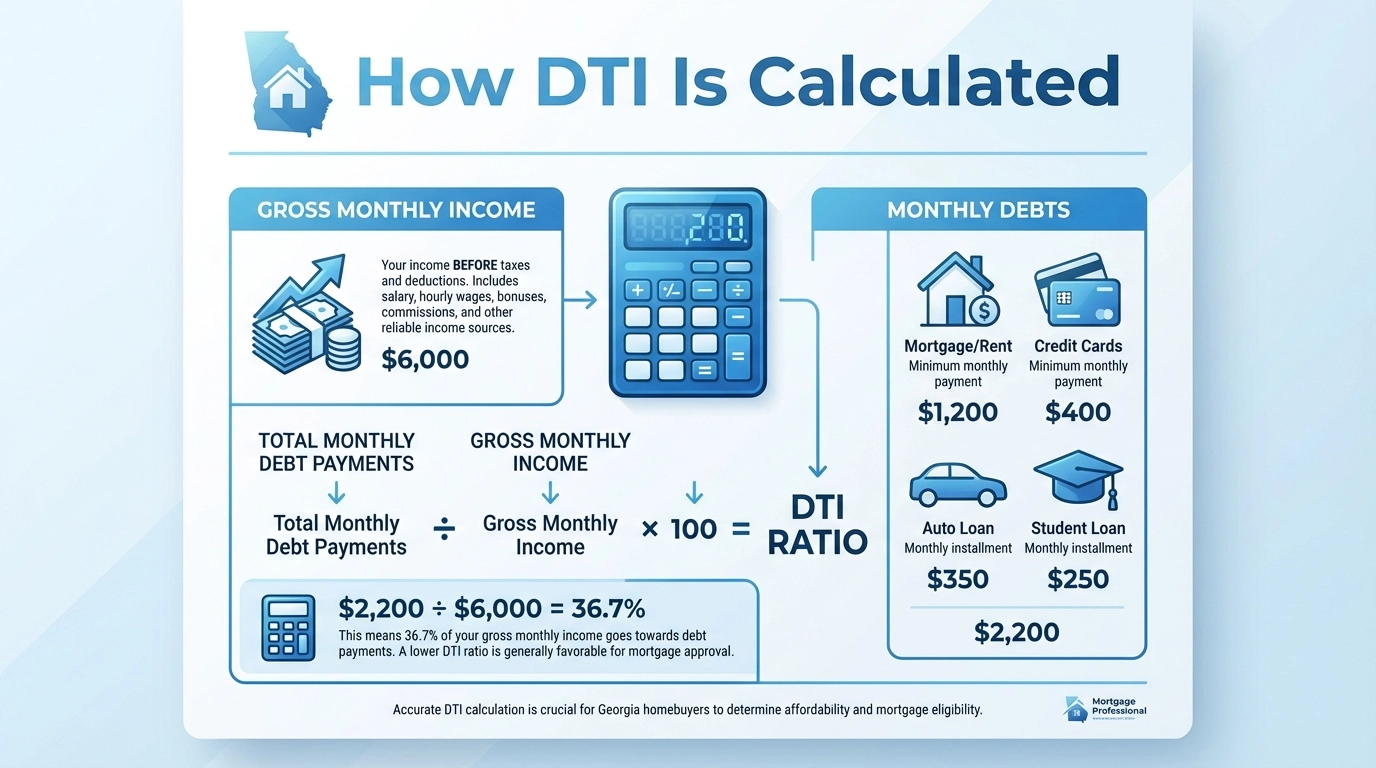

Front-End vs Back-End DTI (Know the Difference!)

Front-End DTI (a.k.a. housing ratio): Proposed total house payment only (PITI + HOA + mortgage insurance) ÷ gross monthly income.

Back-End DTI: All monthly debts including the proposed house payment ÷ gross monthly income. This is the big one most lenders care about.

PITI = Principal + Interest + Property Taxes + Homeowner’s Insurance (+ Mortgage Insurance, if applicable)

What Debts Count (Included) vs Don’t Count (Excluded)

Included in DTI:

Proposed mortgage payment (PITI + HOA dues, if any)

Minimum credit card payments

Auto, personal, and installment loans

Student loans (actual payment; if none reporting, program rules may apply)

Child support, alimony, and court-ordered payments

Tax installment plans

HELOC minimum payment

Co-signed loans (if you’re liable and no 12-month proof of someone else paying)

Usually excluded from DTI:

Utilities, phones, internet, streaming, and subscriptions

Groceries, gas, childcare/daycare (unless required by specific programs)

Car insurance, health insurance, and general living expenses

401(k)/retirement contributions

401(k) loan payments are typically excluded, but some lenders may consider them—ask us

Note: Student loan treatment varies by program and underwriting system. We’ll guide you so it’s done right.

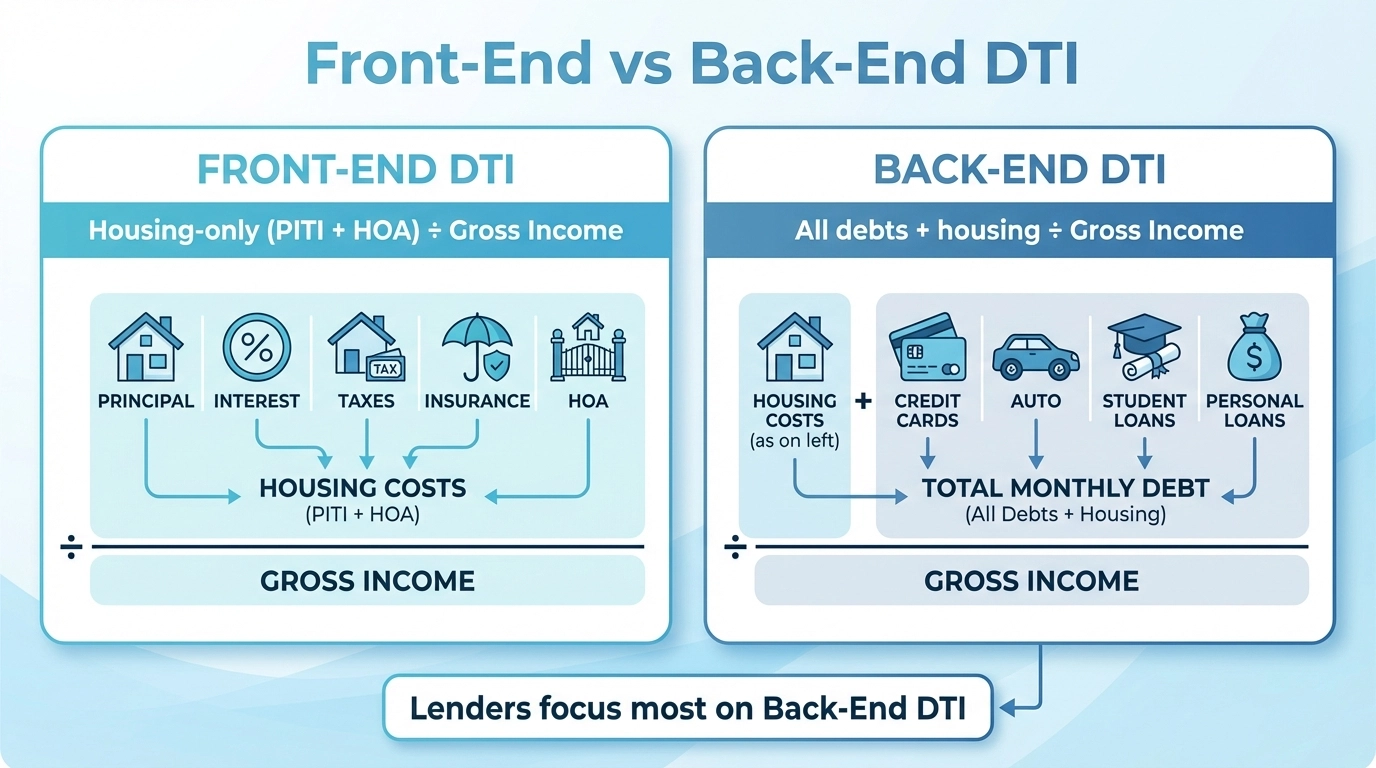

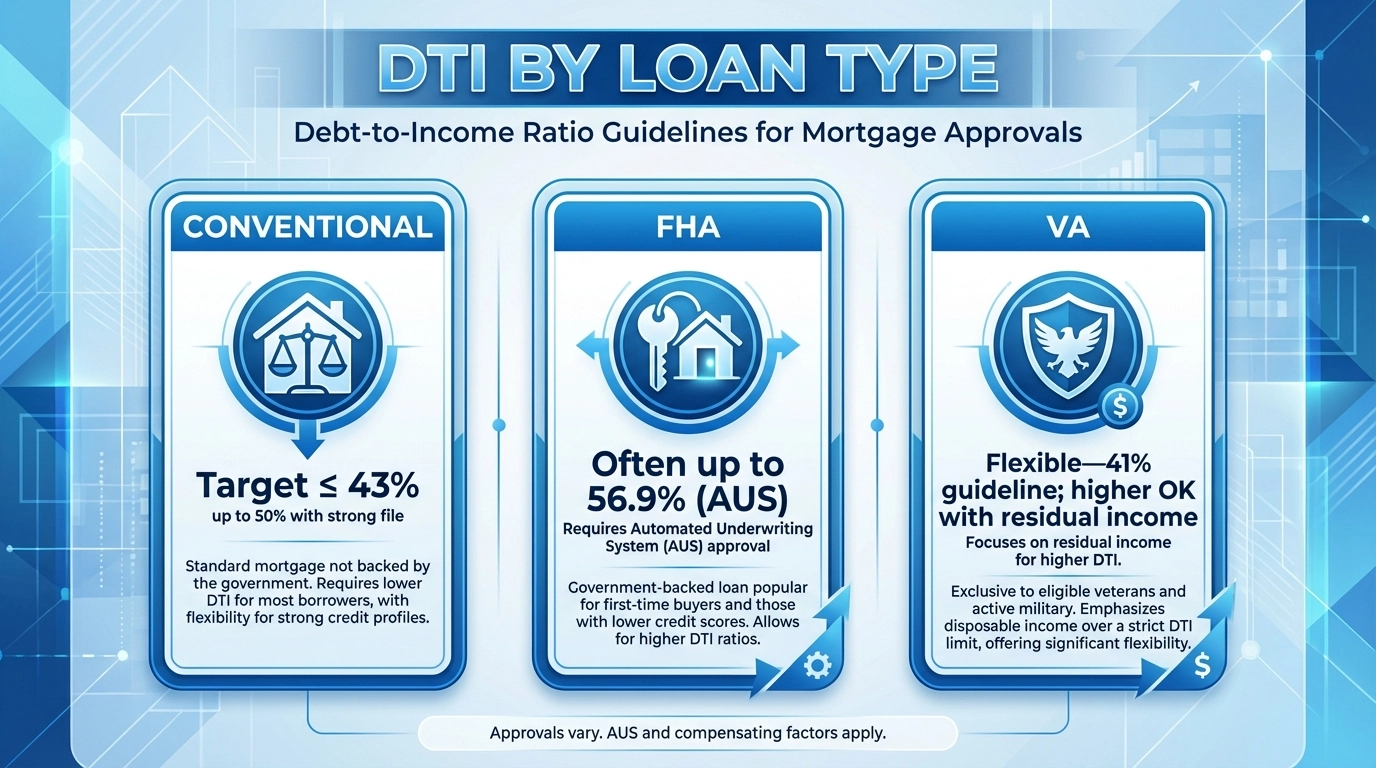

Ideal DTI Targets by Loan Type

These are common caps when the automated underwriting system (AUS) approves the file and other strengths are present. Your exact approval can vary.

Conventional: Aim for ≤ 43%; up to 50% is possible with strong factors

FHA: Often up to 56.9% back-end DTI with AUS approval

VA: Very flexible; 41% is a guideline, but approvals higher are common if residual income and other factors check out

Important: AUS findings, credit profile, reserves, and property factors all matter. We’ll run scenarios for you - no guesswork!

How To Calculate DTI (Step-by-Step)

Add up your monthly debt minimums (see Included list).

Estimate your new total house payment (PITI + HOA).

Add them together for back-end DTI.

Divide by your gross monthly income (before taxes).

Multiply by 100 to get a percentage.

Calculator-Style Example 1 (Conventional Scenario)

Inputs:

Gross Monthly Income: $6,000

Proposed PITI: $1,800

HOA: $0

Car Loan: $350

Student Loan: $75

Credit Cards (minimums): $125

Calculations:

Front-End DTI = $1,800 ÷ $6,000 = 30.0%

Back-End DTI = ($1,800 + $350 + $75 + $125) ÷ $6,000

Back-End DTI = $2,350 ÷ $6,000 = 39.2%

Result:

30% / 39.2% is comfortable for many Conventional approvals.

Calculator-Style Example 2 (FHA Flexibility)

Inputs:

Gross Monthly Income: $5,500

Proposed PITI: $2,100

Car Loan: $500

Student Loan: $200

Credit Cards: $100

Calculations:

Front-End DTI = $2,100 ÷ $5,500 = 38.2%

Back-End DTI = ($2,100 + $500 + $200 + $100) ÷ $5,500

Back-End DTI = $2,900 ÷ $5,500 = 52.7%

Result:

52.7% can be within FHA’s typical AUS-approval range (often up to 56.9%). Strong chance with solid credit and compensating factors.

Calculator-Style Example 3 (VA - More About Residual Income)

Inputs:

Gross Monthly Income: $6,500

Proposed PITI: $2,400

Car Loan: $300

Credit Cards: $100

Calculations:

Back-End DTI = ($2,400 + $300 + $100) ÷ $6,500

Back-End DTI = $2,800 ÷ $6,500 = 43.1%

Result:

VA looks hard at “residual income” by family size/region. A 43.1% DTI can be fine if residual income passes and overall profile is solid.

Why DTI Matters To Lenders

Ability-to-Repay (ATR) and Qualified Mortgage (QM) rules: DTI is a core risk metric.

Predicts payment stress: Lower DTI = lower risk of default.

AUS decisions: Your DTI, credit, assets, and property all interact to produce an approval.

Bottom line: A right-sized DTI helps you lock in the home you love - confidently and on time.

Simple Ways To Improve Your DTI (FAST WINS!)

Pay down revolving balances to reduce minimums. Even $500 can drop the reported payment and your DTI!

Eliminate a small installment loan. Zeroing out a $40–$75 payment often moves the needle.

Avoid new debt and don’t co-sign before closing.

Increase verifiable income. Overtime, bonuses, or a part-time W-2 can help once documented.

Add a co-borrower with income and low debts.

Consider a longer loan term on auto debt to lower the monthly payment (be mindful of interest cost).

Choose the right loan program. FHA can allow higher DTI; VA can be flexible with strong residual income.

Pick the right price point. Adjust the target payment to fit within the approval window.

Use seller credits to pay off small debts at closing (if allowed by program). Smart and strategic!

Pro tip: A temporary rate buydown usually does not lower the qualifying payment. A permanent buydown might. We’ll model both for you.

DTI “Napkin Calculator” You Can Use Right Now

Write your gross monthly income at the top.

Estimate your monthly house payment (PITI + HOA).

List your other monthly debt minimums.

Add up the debts. Divide by income. That’s your DTI!

Aim for:

Conventional: ≤ 43% target; ≤ 50% possible

FHA: ≤ 56.9% possible

VA: Flexible—residual income is key

FAQs

Does rent count? Only the new proposed mortgage payment counts in the new DTI. Your current rent is not included unless required for a specific calculation.

Do utilities and subscriptions count? No.

What about student loans on income-driven plans? We use the documented payment. If none reports, program rules apply (we’ll advise case-by-case).

Can I get approved above these numbers? Sometimes yes, with AUS approval and strong compensating factors.

Is net income used? No, DTI uses gross income (before taxes) in most cases.

THANK YOU For Reading! Let’s Talk Through Your Numbers

We’re here to make this EASY and CLEAR - no guesswork, no stress. THANK YOU for the opportunity to serve you!

Turner Mortgage Team

Brett Turner, Mortgage Loan Officer

Serving Georgia, Tennessee, and Florida

Get Pre-Approved: https://turnermortgageteam.com

Questions right now? Reach out and we’ll run your exact scenario and give you a game plan!